The year 2021 began with many tax innovations, most of which are beneficial to companies.

We have tried to summarize in this article the main tax changes that is important to take into account this year’s companies, namely we have also highlighted some of the changes that will come into force only in 2022, but for which companies should be well prepared already this year.

Corporation tax

In the case of corporation tax, some clarifications were made concerning the deductibility of certain expenses. Although several amendments have been proposed, some have been postponed.

The following are considered entirely deductible:

- the employer’s expenditure on telework is a deductible expenditure to determine the tax result;

- are fully deductible in the calculation of tax revenue, expenditure on the operation of early education institutions;

- credit value adjustments will be fully deductible in the calculation of the tax outturn if the receivables meet certain cumulative conditions, only from 2022;

- and the provisions on the consolidated tax result of a tax group will also bring them to the attention of 2022 when they enter into force.

Income tax on micro-enterprises

The tax base to which the tax is applied is modified: to determine the taxable base of the income of micro-enterprises, the dividends received by a Romanian legal person are deducted.

As for eligibility to the income limit (EUR 1.000.000), the same elements that constitute the tax base (not the same income, is a change of expression) will be taken into account.

Income tax

Among the deductible expenses in the calculation of income tax are added:

- the cost of depreciation of personal assets intended for the pursuit of the business, in accordance with the law;

- expenditure on the purchase of electronic fiscal machines labelled, put into operation in that year, in accordance with the law;

- a special provision on the refund of dividend tax is introduced. If the annual adjustment of dividends paid as a result of a partial distribution during the financial year gives rise to repayments from the financial statements, the dividend payer submits a request for reimbursement to the competent tax authority after the member or shareholders have returned the dividends and until the expiry of the limitation period for the right to request reimbursement. The implementation procedure must be approved by order of the Minister for Public Finance.

Nor is it taxable for income tax purposes expenses referred to in the following chapter, which are not subject to the basis for calculating social contributions.

Social contributions

Clarification was also provided on the amounts not included in the basis for calculating social contributions:

- services in the form of private use of vehicles not used exclusively for the purpose of economic activity, owned or used by legal persons applying micro-enterprise taxation or activity-specific tax;

- the amounts granted to employees performing telework activities to support utilitarian expenditure at the place where the employees work within the limits fixed by the employer by the contract of employment or by the rules of procedure, but limited in a monthly ceiling of 400 lei corresponding to the number of days in the month in which the person operates as a tele-based activity. The amounts will be granted without the need to submit supporting documents;

- coverage of the costs of epidemiological tests and employee vaccination to prevent the spread of diseases dangerous to health;

- the sums paid by the employer for the first education of the children of employees.

Value added tax

The ceiling for a taxpayer to be considered eligible for the application of the VAT system at the time of receipt has changed. This new ceiling shall be set on the basis of turnover for the previous calendar year and shall not exceed 4,500,000 lei. The old ceiling was 2,250,000 lei.

The adjustment of the VAT base shall be made even if the total or partial consideration of the goods or services supplied has not been received by the beneficiaries of the natural person within 12 months of the payment deadline set by the parties, or, failing that, from the date of issue of the invoice (transactions with external related parties). Of course, the person making the adjustment will have to prove that he has made every effort to recover his request.

The reduced VAT rate (5%) applies from 2022 to the supply of dwellings with a useful area of 120 m2 or less, excluding dwellings for domestic use, the value of which, including the land on which they are built, does not exceed 450,000 lei. The same ceiling remained, although the ceiling was raised to EUR 140000.

A supply of goods falling within the scope of VAT shall not constitute a transfer of ownership of immovable property by a taxable person to a public body for the purpose of settling an outstanding tax debt.

The VAT payable or paid for the purchase of alcoholic beverages and tobacco products may be deducted if those goods are used for the supply of services or for their freedom to provide services for advertising or promotional purposes.

From 2021, transactions with the United Kingdom will follow the extra-Community rule, with the exception of the supply/purchase of goods with Northern Ireland, which in terms of goods transactions is considered EU member.

The deadline for the refund of VAT with subsequent verification was extended until 31 March 2021.

Own-funds

2021 is the year in which tax incentives are applied to increase the own funds, which concern the reduction of corporation tax or the income of the micro-enterprise, as established by the O.U.G. n. 153/2020.

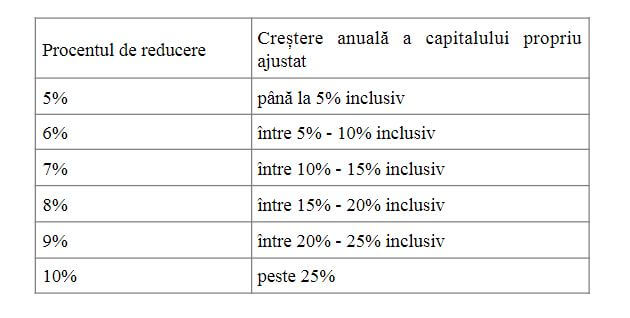

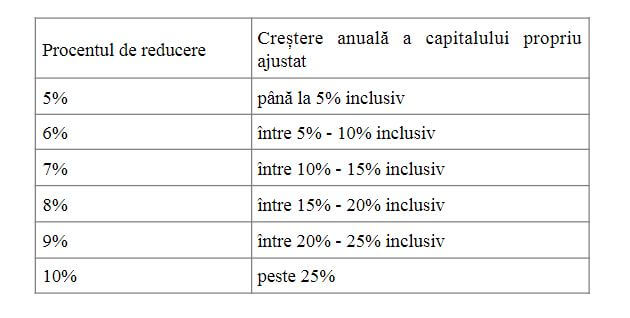

The rates of reduction of these taxes are as follows:

(a) 2 % if the net book value is positive. At the same time it must be at least half of the subscribed share capital;

(b) if it records an adjusted annual capital increase against adjusted capital recorded in the preceding year and also meets the condition set out in point (a), the reductions are as follows:

Local taxes and charges

Clarifications were provided on the tax base for non-residential buildings owned by individuals. In the case of mixed buildings, if the owner does not report to the tax administration the area used for commercial real estate for residential purposes, the property tax is calculated at the rate of 0,3 % on the tax base determined in accordance with the rules for residential buildings owned by individuals.

The deadline will be increased from 3 to 5 years for updating the rateable value of buildings owned by legal entities from 1 July 2021 (as regards taxation this provision will be heard from 2022).

The change declaration will be made only if the building is a non-resident destination, which causes the taxable value of the building to increase or decrease by more than 25%.

For the purpose of setting the tax on mixed buildings owned by individuals who at 31 December 2020 own mixed buildings shall submit a declaration on their own responsibility by 15 March 2021 inclusive, on the area used for non-mixed residential buildings, except for individuals whose areas used for non-residential purposes have been declared to the Tax Board by 31 December 2020.

Other important provisions:

- the specific tax exemption is extended for a period of 90 days from 1 January 2021;

- the request for cancellation of accessories pursuant to OUG 69/2020 may also be submitted between 1 January 2021 and 31 March 2021;

- for the HoReCa area, an aid scheme granted to the beneficiaries in the form of grants to cover part of the travel agencies’ turnover or loss of turnover (in 2020 compared to 2019) of 20% has been published. The CAEN codes mentioned are: 7911, 7912, 7990, 5510, 5520, 5530, 5590, 5610, 5621, 5629, 5630 (according to OUG 224/2020);

- another clarification concerns the tax exemption for reinvested profits, in the sense that it will be granted within the limit of corporate tax calculated on a cumulative basis from the beginning of the year to the quarter of the assets put into service, taxpayers applying the quarterly corporate tax return and payment system, which corresponds to the amount of tax on profits calculated cumulatively from the beginning of the year in which the assets were put into service until the end of that year for taxpayers applying the annual corporate income tax return and payment system. It was only previously claimed that the exemption from corporation tax on investments made was granted within the limit of the corporate tax due for that period.

Last but not least, the deadlines for the submission of certain declarations have been amended, e.g. the tax ceilings have been updated. Find out more here.